What Past Recessions Tell Us About the Housing Market

It doesn’t matter if you’re someone who closely follows the economy or not, chances are you’ve heard whispers of an upcoming recession. Economic conditions are determined by a broad range of factors, so rather than explaining them each in depth, let’s lean on the experts and what history tells us to see what could lie ahead. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“Two-in-three economists are forecasting a recession in 2023 . . .”

As talk about a potential recession grows, you may be wondering what a recession could mean for the housing market. Here’s a look at the historical data to show what happened in real estate during previous recessions to help prove why you shouldn’t be afraid of what a recession could mean for the housing market today.

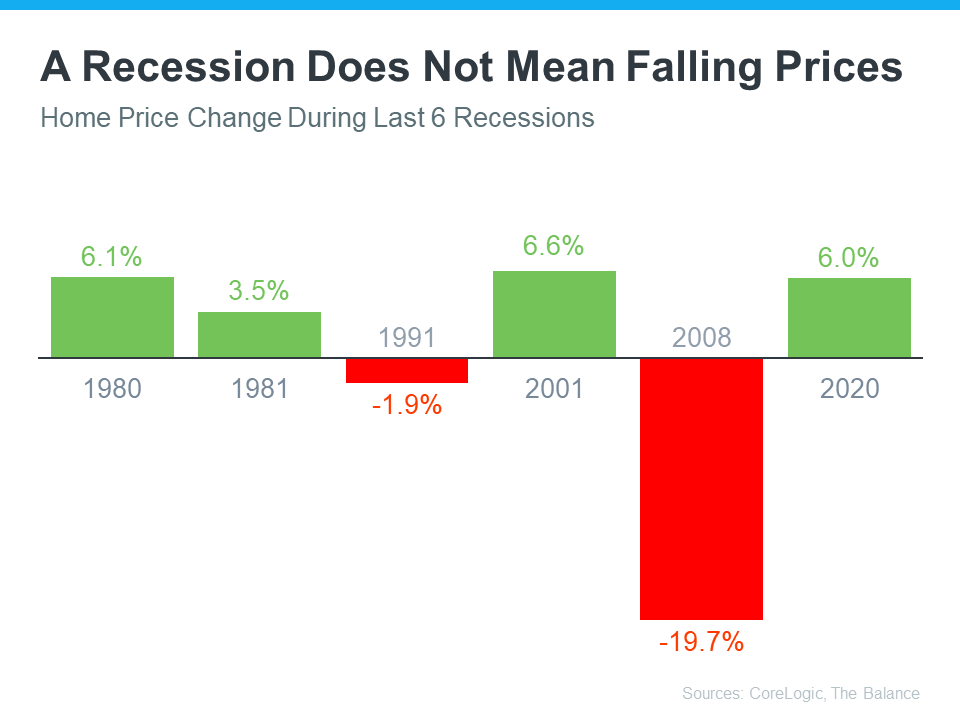

A Recession Doesn’t Mean Falling Home Prices In San Antonio

To show that San Antonio home prices don’t fall every time there’s a recession, it helps to turn to historical data. As the graph below illustrates, looking at recessions going all the way back to 1980, home prices appreciated in four of the last six of them. So historically, when the economy slows down, it doesn’t mean home values will always fall.

Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph above) and think another recession would be a repeat of what happened to housing then. But today’s housing market isn’t about to crash because the fundamentals of the market are different than they were in 2008. According to experts, home prices will vary by market and may go up or down depending on the local area. But the average of their 2023 forecasts shows prices will net neutral nationwide, not fall drastically like they did in 2008.

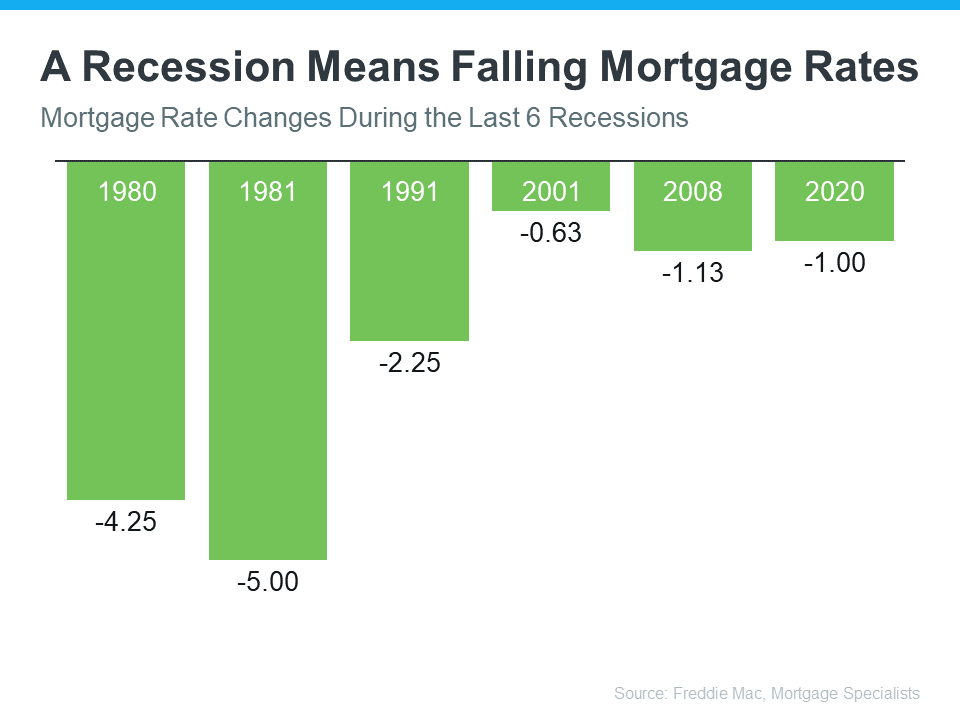

A Recession Means Falling Mortgage Rates

Research also helps paint the picture of how a recession could impact the cost of financing a home. As the graph below shows, historically, each time the economy slowed down, mortgage rates decreased.

Fortune explains mortgage rates typically fall during an economic slowdown:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

In 2023, market experts say mortgage rates will likely stabilize below the peak we saw last year. That’s because mortgage rates tend to respond to inflation. And early signs show inflation is starting to cool. If inflation continues to ease, rates may fall a bit more, but the days of 3% are likely behind us.

The big takeaway is you don’t need to fear the word recession when it comes to San Antonio housing. In fact, experts say a recession would be mild and housing would play a key role in a quick economic rebound. As the 2022 CEO Outlook from KPMG, says:

“Global CEOs see a ‘mild and short’ recession, yet optimistic about global economy over 3-year horizon . . .

More than 8 out of 10 anticipate a recession over the next 12 months, with more than half expecting it to be mild and short.”

Bottom Line

While history doesn’t always repeat itself, we can learn from the past. According to historical data, in most recessions, home values have appreciated and mortgage rates have declined.

If you’re thinking about buying or selling a home in San Antonio this year, let’s connect so you have expert advice on what’s happening in the housing market and what that means for your homeownership goals.

The Truth About Negative Home Equity Headlines

Home equity has been a hot topic in real estate news lately. And if you’ve been following along, you may have heard there’s a growing number of San Antonio homeowners with negative equity. But don’t let those headlines scare you.

In truth, the headlines don’t give you all the information you really need to understand what’s happening and at what scale. Let’s break down one of the big equity stories you may be seeing in the news, and what’s actually taking place. That way, you’ll have the context you need to understand the big picture.

Headlines Focus on Short-Term Equity Numbers and Fail To Convey the Long-Term View

One piece of news circulating focuses on the percentage of San Antonio homes purchased in 2022 that are currently underwater. The term underwater refers to a scenario where the homeowner owes more on the loan than the house is worth. This was a huge issue when the housing market crashed in 2008, but it's much less significant today.

Media coverage right now is based loosely on a report from Black Knight, Inc. The actual report from that source says this:

“Of all homes purchased with a mortgage in 2022, 8% are now at least marginally underwater and nearly 40% have less than 10% equity stakes in their home, . . .”

Let’s unpack that for a moment and provide the bigger picture. The data-bound report from Black Knight is talking specifically about homes purchased in 2022, but media headlines don’t always mention that timeframe or provide the surrounding context about how unusual of a year 2022 was for the housing market. In 2022, home price appreciation soared, and it reached its max around March-April. Since then, the rate of appreciation has been slowing down.

Homeowners who bought their house last year right at the peak or those who paid more than market value in the months that followed are more likely to fall into the category of being marginally underwater. The qualifier marginally is another key piece of the puzzle the media isn’t necessarily including in their coverage.

So, what does that mean for those who purchased a home in 2022? It’s important to remember, owning a home is a long-term investment, not a short-term play. When headlines focus on the short-term view, they’re not necessarily providing the full context.

Typically speaking, the longer you stay in your home, the more equity you gain as you pay down your loan and as home prices appreciate. With recent market conditions, you may not have gained significant equity right away if you owned the home for just a few months. But it’s also true that many homeowners who recently bought their house are unlikely to be looking to sell quite yet.

Bottom Line

As with everything, knowing the context is important. If you have questions about real estate headlines or about how much equity you have in your San Antonio home, let’s connect.

What Experts Are Saying About the 2023 San Antonio Housing Market

If you’re thinking about buying or selling a home in San Antonio soon, you probably want to know what you can expect from the housing market this year. In 2022, the market underwent a major shift as economic uncertainty and higher mortgage rates reduced buyer demand, slowed the pace of home sales, and moderated home prices. But what about 2023?

An article from HousingWire offers this perspective:

“The red-hot housing market of the past 2 ½ years was characterized by sub-three percent mortgage rates, fast-paced bidding wars and record-low inventory. But more recently, market conditions have done an about-face. . . . now is the opportunity for everyone to become re-educated about what a ‘typical’ housing market looks like.”

This year, experts agree we may see the return of greater stability and predictability in the housing market if inflation continues to ease and mortgage rates stabilize. Here’s what they have to say.

The 2023 forecast from the National Association of Realtors (NAR) says:

“While 2022 may be remembered as a year of housing volatility, 2023 likely will become a year of long-lost normalcy returning to the market, . . . mortgage rates are expected to stabilize while home sales and prices moderate after recent highs, . . .”

Danielle Hale, Chief Economist at realtor.com, adds:

“. . . buyers will not face the extreme competition that was commonplace over the past few years.”

Lawrence Yun, Chief Economist at NAR, explains home prices will vary by local area, but will net neutral nationwide as the market continues to adjust:

“After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.”

Mark Fleming, Chief Economist at First American, says:

“The housing market, once adjusted to the new normal of higher mortgage rates, will benefit from continued strong demographic-driven demand relative to an overall, long-run shortage of supply.”

Bottom Line

If you’re looking to buy or sell a home in San Antonio this year, the best way to ensure you’re up to date on the latest market insights is to partner with a trusted real estate advisor. Let’s connect.

3 Best Practices for Selling Your House in San Antonio This Year

A new year brings with it the opportunity for new experiences. If that resonates with you because you’re considering making a move, you’re likely juggling a mix of excitement over your next home and a sense of attachment to your current one.

A great way to ease some of those emotions and ensure you’re feeling confident in your decision is to keep these three best practices in mind.

1. Price Your Home Right

The San Antonio housing market shifted in 2022 as mortgage rates rose, buyer demand eased, and the number of homes for sale grew. As a seller, you’ll want to recognize things are different now and price your house appropriately based on where the market is today. Greg McBride, Chief Financial Analyst at Bankrate, explains:

“Price your home realistically. This isn’t the housing market of April or May, so buyer traffic will be substantially slower, but appropriately priced homes are still selling quickly.”

If you price your house too high, you run the risk of deterring buyers. And if you go too low, you’re leaving money on the table. An experienced real estate agent can help determine what your ideal asking price should be.

2. Keep Your Emotions in Check

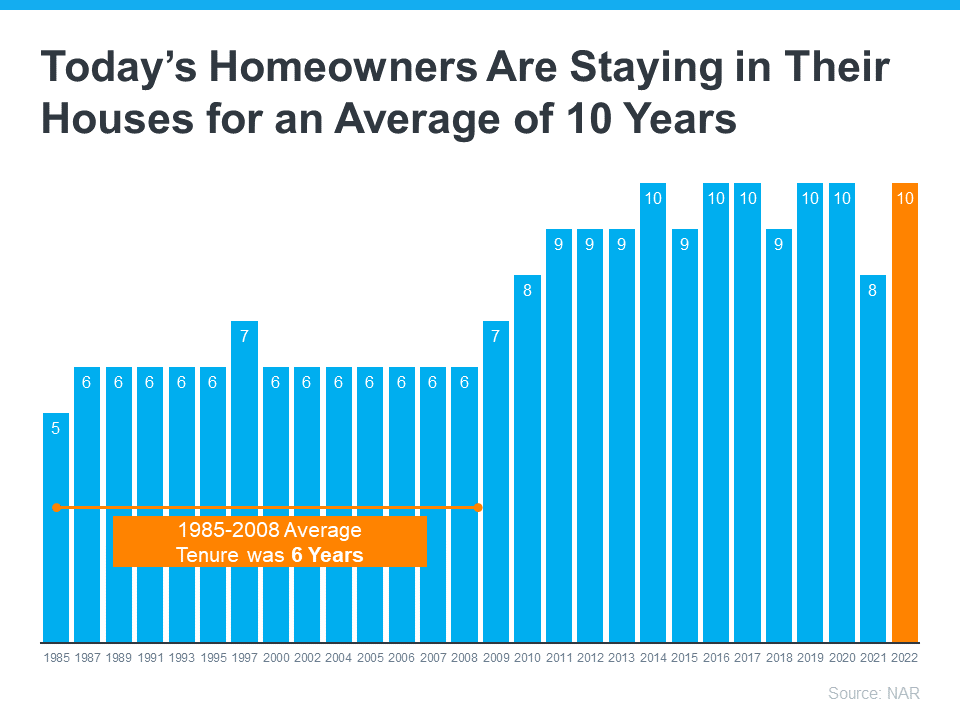

Today, San Antonio homeowners are living in their houses longer. According to the National Association of Realtors (NAR), since 1985, the average time a homeowner has owned their home has increased from 5 to 10 years (see graph below):

This is several years longer than what used to be the historical norm. The side effect, however, is when you stay in one place for so long, you may get even more emotionally attached to your space. If it’s the first home you bought or the house where your loved ones grew up, it very likely means something extra special to you. Every room has memories, and it’s hard to detach from the sentimental value.

For some homeowners, that makes it even harder to negotiate and separate the emotional value of the house from fair market price. That’s why you need a real estate professional to help you with the negotiations along the way.

3. Stage Your Home Properly

While you may love your decor and how you’ve customized your San Antonio home over the years, not all buyers will feel the same way about your design. That’s why it’s so important to make sure you focus on your home’s first impression so it appeals to as many buyers as possible. As NAR says:

“Staging is the art of preparing a home to appeal to the greatest number of potential buyers in your market. The right arrangements can move you into a higher price-point and help buyers fall in love the moment they walk through the door.”

Buyers want to envision themselves in the space so it truly feels like it could be their own. They need to see themselves inside with their furniture and keepsakes – not your pictures and decorations. A real estate professional can help you with tips to get your house ready to sell.

Bottom Line

If you’re considering selling your house in San Antonio, let’s connect so you have the help you need to navigate through the process while prioritizing these best practices.

Planning To Sell Your House in San Antonio? It’s Critical To Hire a Pro.

With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you’re thinking of selling your house, it’s important to understand how the market has changed and what that means for you. The best way to make sure you’re in the know is to work with a trusted housing market expert.

Here are five reasons working with a professional can ensure you’ll get the most out of your sale.

1. A Real Estate Advisor Is an Expert on San Antonio Market Trends

Leslie Rouda Smith, 2022 President of the National Association of Realtors (NAR), explains:

"During challenging and changing market conditions, one thing that's calming and constant is the assurance that comes from a Realtor® being in your corner through every step of the home transaction. Consumers can rely on Realtors®' unmatched work ethic, trusted guidance and objectivity to help manage the complexities associated with the home buying and selling process.”

An expert real estate advisor has the latest information about national trends and your local area too. More importantly, they’ll know what all of this means for you so they’ll be able to help you make a decision based on trustworthy, data-bound information.

2. A Local Professional Knows How To Set the Right Price for Your House

Home price appreciation has moderated this year. If you sell your house in San Antonio on your own, you may be more likely to overshoot your asking price because you’re not as aware of where prices are today. If you do, you run the risk of deterring buyers or seeing your house sit on the market for longer.

Grell Realty Group provides an unbiased eye when they help you determine a price for your house. They’ll use a variety of factors, like the condition of your home and any upgrades you’ve made, and compare your house to recently sold homes in your area to find the best price for today’s market. These steps are key to making sure it’s set to move as quickly as possible.

3. Grell Realty Group Helps Maximize Your Pool of Buyers

Since buyer demand has cooled this year, you'll want to do what you can to help bring in more buyers. Real estate professionals have a large variety of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS) to ensure your house gets in front of people looking to make a purchase. Investopedia explains why it’s risky to sell on your own without the network an agent provides:

“You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home.”

Without access to the tools and your agent’s marketing expertise, your buyer pool – and your San Antonio home’s selling potential – is limited.

4. A Real Estate Expert Will Read – and Understand – the Fine Print

Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. NAR explains it like this:

“Selling a home typically requires a variety of forms, reports, disclosures, and other legal and financial documents. . . . Also, there’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.”

A real estate professional knows exactly what all the fine print means and how to work through it efficiently. They’ll help you review the documents and avoid any costly missteps that could occur if you try to handle them on your own.

5. A Trusted Advisor Is a Skilled Negotiator

In today’s market, buyers are also regaining some negotiation power as bidding wars ease. If you sell without a professional, you’ll also be responsible for any back-and-forth. That means you’ll have to coordinate with:

- The buyer, who wants the best deal possible

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

Instead of going toe-to-toe with all the above parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion.

Bottom Line

Don’t go at it alone. If you’re planning to sell your house in San Antonio this winter, let’s connect so you have an expert by your side to guide you in today’s market.

Recent Posts

![Achieve Your Dream of Homeownership with Condos and Townhomes [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20240217/16/w600_original_dfa7c035-5dfc-431f-9632-0a1387532bd1-png.webp)

![Winning Plays for Buying a Home in Today’s Market [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20240210/16/w600_original_949ffbaa-7b98-4ded-bdcb-710d8e954a85-png.webp)