What’s Causing Ongoing Boerne Home Price Appreciation?

If you’re thinking about making a move in Boerne, you probably want to know what’s going to happen to home prices for the rest of the year. While experts say price growth will moderate due to the shifting market, ongoing appreciation is expected. That means home prices won’t fall. Here’s a look at two key reasons experts forecast continued price growth: supply and demand.

While Growing, Housing Supply Is Still Low

Even though inventory is increasing in Boerne this year as the market moderates, supply is still low. The graph below helps tell the story of why there still aren’t enough homes on the market today. It uses data from the Census to show the number of single-family homes that were built in this country going all the way back to the 1970s.

The blue bars represent the years leading up to the housing crisis in 2008. As the graph shows, right before the crash, homebuilding increased significantly. That’s because buyer demand was so high due to loose lending standards that enabled more people to qualify for a home loan.

The resulting oversupply of homes for sale led to prices dropping during the crash and some builders leaving the industry or closing their businesses – and that led to a long period of underbuilding of new homes. And even as more new homes are constructed this year and in the years ahead, this isn’t something that can be resolved overnight. It’ll take time to build enough homes to meet the deficit of underbuilding that took place over the past 14 years.

Millennials Will Create Sustained Buyer Demand Moving Forward

The frenzy the market saw during the pandemic is because there was more demand than homes for sale. That drove home prices up as buyers competed with one another for available homes. And while buyer demand has moderated today in response to higher mortgage rates, data tells us demand will continue to be driven by the large generation of millennials aging into their peak homebuying years (see graph below):

Odeta Kushi, Deputy Chief Economist at First American, explains:

“. . . millennials continue to transition to their prime home-buying age and will remain the driving force in potential homeownership demand in the years ahead.”

That combination of millennial demand and low housing supply continues to put upward pressure on home prices. As Bankrate says:

“After all, supplies of homes for sale remain near record lows. And while a jump in mortgage rates has dampened demand somewhat, demand still outpaces supply, thanks to a combination of little new construction and strong household formation by large numbers of millennials.”

What This Means for Home Prices

If you’re worried home values will fall in Boerne, rest assured that experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand. That means home prices won’t decline.

Bottom Line

Based on today’s factors driving supply and demand, experts project home price appreciation in Boerne will continue. It’ll just happen at a more moderate pace as the housing market continues its shift back toward pre-pandemic levels.

How Your Equity Can Grow over Time

It’s true that record levels of home price appreciation in Boerne have spurred significant equity gains for homeowners over the past few years. As Diana Olick, Real Estate Correspondent at CNBC, says:

“The stunning jump in home values over the course of the Covid-19 pandemic has given U.S. homeowners record amounts of housing wealth.”

That’s great for your home’s value over the last couple of years, but what if you’ve lived in your home for longer than that? You may be wondering how much equity you truly have.

The National Association of Realtors (NAR) has done a study to calculate the typical equity gains over longer spans of time. The data they compiled could be enough to motivate you to move. Just remember, to find out how much equity you have in your specific home, you’ll want to get a professional equity assessment from a trusted real estate advisor.

How Your Equity Grows

Let’s start by establishing how you build equity in your home. While price appreciation is clearly a factor that can help boost your equity, you also build equity over time as you pay down your home loan. NAR explains:

“Home equity gains are built up through price appreciation and by paying off the mortgage through principal payments.”

Average Equity Growth over Time

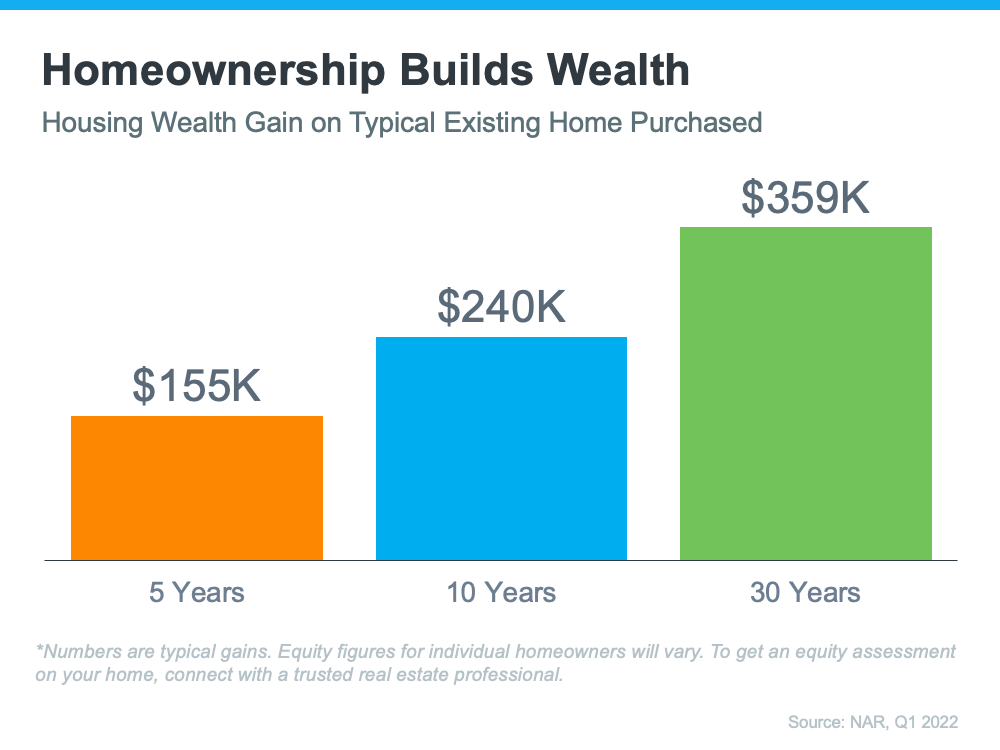

The study from NAR breaks down the typical equity gain over time (see graph below). It calculates the equity a homeowner potentially gained if they purchased the median-priced home 5, 10, or 30 years ago and still own it today.

These six-figure numbers are impressive and certainly enough to help you fuel a move into your next home, but they’re not a promised amount. Remember, your own equity gain will be different. It depends on how long you’ve been in the house, your home’s condition, any upgrades you’ve made, your area, and much more.

If you want to find out how much equity you have, partner with a trusted real estate professional for an equity assessment on your home. They can provide an expert opinion on what your house is worth today and how the equity you’ve gained over time can help you when you purchase your next home. It may be some (if not all) of what you need for your next down payment.

Bottom Line

If you’re thinking about selling your house in Boerne and making a move, home equity can be a real game-changer, especially if you’ve been in your current home for a while. If you’re ready to find out how much equity you have, let’s connect.

Homeownership Is a Great Hedge Against the Impact of Rising Inflation

If you’re following along with the news today, you’ve heard about rising inflation. Today, inflation is at a 40-year high. According to the National Association of Home Builders (NAHB):

“Consumer prices accelerated again in May as shelter, energy and food prices continued to surge at the fastest pace in decades. This marked the third straight month for inflation above an 8% rate and was the largest year-over-year gain since December 1981.”

With inflation rising, you’re likely feeling it impact your day-to-day life in Boerne as prices go up for gas, groceries, and more. These climbing consumer costs can put a pinch on your wallet and make you re-evaluate any big purchases you have planned to ensure they’re still worthwhile.

If you’ve been thinking about purchasing a home this year, you’re probably wondering if you should continue down that path or if it makes more sense to wait. While the answer depends on your situation, here’s how homeownership can help you combat the rising costs that come with inflation.

Homeownership Helps You Stabilize One of Your Biggest Monthly Expenses

Investopedia explains that during a period of high inflation, prices rise across the board. That’s true for things like food, entertainment, and other goods and services, even housing. Both rental prices and home prices are on the rise. So, as a buyer, how can you protect yourself from increasing costs? The answer lies in homeownership.

Buying a home in Boerne allows you to stabilize what’s typically your biggest monthly expense: your housing cost. When you have a fixed-rate mortgage on your home, you lock in your monthly payment for the duration of your loan, often 15 to 30 years. James Royal, Senior Wealth Management Reporter at Bankrate, says:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same. That’s certainly not the case if you’re renting.”

So even if other prices increase, your housing payment will be a reliable amount that can help keep your budget in check. If you rent, you don’t have that same benefit, and you won’t be protected from rising housing costs.

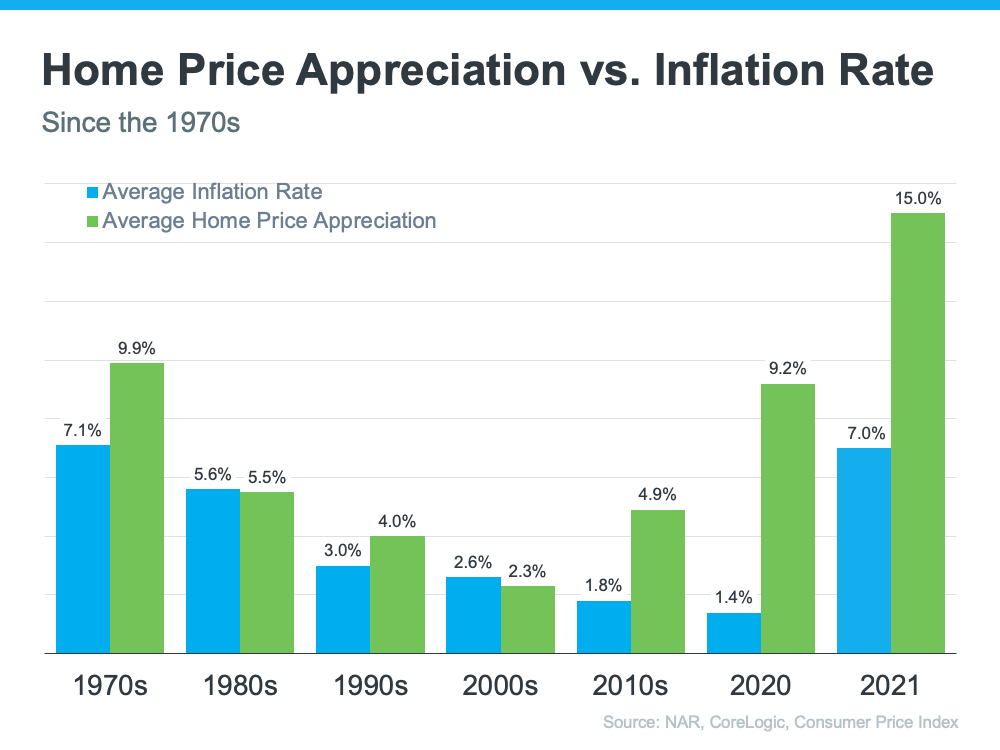

Investing in an Asset That Historically Outperforms Inflation

While it’s true rising home prices and higher mortgage rates mean that buying a house in Boerne today costs more than it did even a few months ago, you still have an opportunity to set yourself up for a long-term win. That’s because, in inflationary times, you want to be invested in an asset that outperforms inflation and typically holds or grows in value.

The graph below shows how the average home price appreciation outperformed the average inflation rate in most decades going all the way back to the seventies – making homeownership a historically strong hedge against inflation (see graph below):

So, what does that mean for you? Today, experts forecast home prices will only go up from here thanks to the ongoing imbalance of supply and demand. Once you buy a house, any home price appreciation that does occur will grow your equity and your net worth. And since homes are typically assets that grow in value, you have peace of mind that history shows your investment is a strong one.

That means, if you’re ready and able, it makes sense to buy today before prices rise further.

Bottom Line

If you’ve been thinking about buying a home in Boerne this year, it makes sense to act soon, even with inflation rising. That way you can stabilize your monthly housing cost and invest in an asset that historically outperforms inflation. If you’re ready to get started, let’s connect so you have expert advice on your specific situation when you’re ready to buy a home.

Recent Posts

![Achieve Your Dream of Homeownership with Condos and Townhomes [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20240217/16/w600_original_dfa7c035-5dfc-431f-9632-0a1387532bd1-png.webp)

![Winning Plays for Buying a Home in Today’s Market [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20240210/16/w600_original_949ffbaa-7b98-4ded-bdcb-710d8e954a85-png.webp)